News, views, tips and tools

Auto-Enrolment in Ireland: What Employers Need to Know

Before leaving office, the Minister for Social Protection, Heather Humphreys, set the wheels in motion for Ireland’s new auto-enrolment pension scheme, officially named My Future Fund. This...

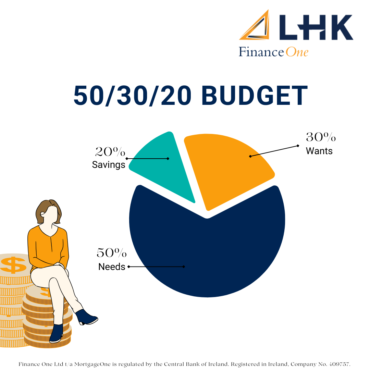

Kickstart Your New Year with a Smart Yearly Budget

Introduction The New Year is the perfect time to set fresh goals and take control of your financial future. One of the most effective ways to do this is by creating a clear, structured yearly...

Blog Post: Don’t Leave It Too Late: Why Starting Your Pension in Your 20s Pays Off

When it comes to financial planning, starting a pension in your 20s is one of the smartest financial decisions you can make. The earlier you start, the more time you give compound interest to work...

Record Mortgage Approvals for First-Time Buyers: How to Navigate Rising Irish Property Prices

Source: Independent.ie First-time buyers in Ireland are breaking records, with more mortgage approvals than ever, despite property prices climbing by 10% annually. According to Independent.ie...

LHK Group comes in first for second year in a row

In an industry where growth often means transition into a larger, more impersonal entity, it can be difficult for a business to maintain the strong family values that have fuelled its success...

Auto Enrolment Update

The Automatic Enrolment Retirement Savings System Act 2024 was signed into law by the President of Ireland on 9th July 2024. The Act provides that it will come into operation when commenced by...

Pension Tax Deadline 2024

It’s that time of the year again. If you pay and file your tax return through the Revenue On-line Service (ROS) you have until 14th November 2024 to contribute to a pension and backdate the tax...

Why Now Is the Perfect Time to Reassess Your Mortgage: Navigating 2024’s Changing Market

Mortgage discussions can often feel overwhelming, particularly over the last few years, given the uncertainty in the market and the unpredictable shifts within the banking sector. However, 2024...

Finance One now part of LHK Group

Finance One is now part of LHK Group Finance One has now merged with the financial planning arm of LHK Group following the acquisition of a majority shareholding in our business by LHK...

Is it easier to get a mortgage through a broker or a bank?

Is it easier to get a mortgage through a mortgage broker or a bank? This article examines what each does, the pros and cons of each route and which is the best option for you when looking to get a...

Financial Advisor wanted for our Mortgage Broker Team

We are looking for a Financial Advisor to join our Mortgage Team. This team continues to grow, and so does our desire to offer our clients a best-in-class service. We are looking to enhance what...

The Mortgage Deposit – our most frequently asked questions

These are the most common questions we get asked when it comes to the mortgage deposit. What level of deposit needs to be shown? Minimum 10% of the purchase price for a first-time buyer (for...

Managing your bank account with a mortgage application in mind

Managing your bank account in the run up to your mortgage application just makes sense. You need to be confident that your bank account is going to withstand the scrutiny of the lender. So here...

Mortgage Documentation – how to get on top of it

Mortgage documentation is your biggest contribution in the initial stages of the application process, but it’s not too difficult to get through it. Our main message to you is to ensure that you...

Mortgage Protection – why you shouldn’t leave it to the last minute

Mortgage Protection is not something you want to leave until the last minute, particularly if you have any previous medical history of note. Click here to download Finance One’s...

Cashback mortgage or non-cashback mortgage? Which is the better option for me?

The cashback mortgage has been around for quite a while now – and it’s showing no sign of going away! Your decision as to whether you want a cashback mortgage or non-cashback will...

Preparing your mortgage application – How to handle cash, cards and your bank account

When preparing your mortgage application, it is important that you know how to manage your bank account and understand the do’s and don’ts of using cash or card. When you do, you can...

Credit History and Mortgage Applications – What you need to know

Poor credit history and mortgage applications are not a match made in heaven. You do not want to bury your head in the sand. Nor do you want to knowingly apply for a mortgage if you have an...

Your mortgage application – How to manage credit cards and overdraft

The success of your mortgage application can be affected by how you handle your credit card and/or an approved overdraft facility. Here’s how to manage them so you don’t get tripped...

Mortgage Deposit – what you need to know as a First-Time Buyer

The following are the most common questions we get asked by First-Time Buyers about the mortgage deposit. What level of deposit does a First-Time Buyer need to show? Minimum 10% of the purchase...

Getting mortgage ready – demonstrating affordability

Getting yourself mortgage ready usually takes some planning and is not usually achieved overnight. And a key part of the process is being able to demonstrate that you can sustain repayments on the...

Guide to House Purchase Costs in Ireland

The area of house purchase costs is one where there is probably an under supply of accurate detail out there. Here is a breakdown of costs you can expect on a home purchase based on a €400,000...